Wondering what home insurance covers for your roof? This article breaks down everything you need to know about home insurance roof coverage. We’ll explain what types of damages are covered, the different coverage options available, common exclusions, and tips for making a claim to ensure you receive the maximum amount you are owed.

Key Takeaways

- Homeowners insurance typically covers roof damage from sudden hazards like storms, but excludes damage from poor maintenance or aging.

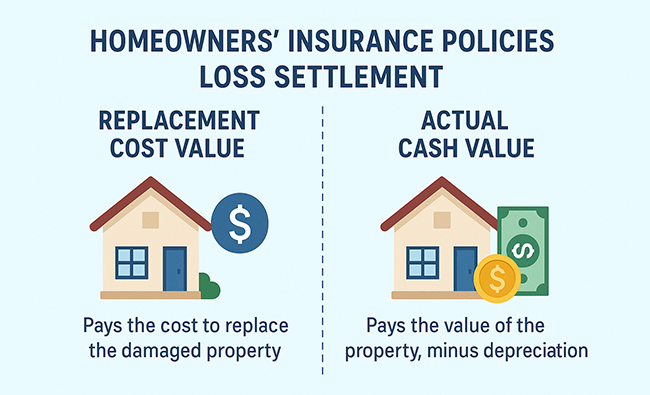

- Roof coverage can be classified as Replacement Cost Value (RCV) or Actual Cash Value (ACV), with RCV offering better financial protection by covering replacement costs without depreciation.

- Regular roof maintenance and inspections are essential for eligibility in insurance coverage, and a new roof can lead to significant reductions in insurance premiums.

What Does Home Insurance Typically Cover for Roofs?

Homeowners’ insurance often includes roof coverage for damage due to specific events like fire, wind, hail, and other events. Typically, a standard homeowners’ insurance policy covers roof damage resulting from sudden hazards, such as storms, but excludes damage caused by negligence or normal wear and tear. For instance, if a fierce storm lifts shingles or hail impacts your roof, your dwelling coverage will likely cover the cost of repairs. Additionally, home insurance covers various aspects of your property, ensuring comprehensive protection. Insurance coverage for the roof is an important consideration for homeowners.

However, understanding the exclusions in your policy is vital. Home insurance typically does not cover roof damage due to poor maintenance or aging. Being aware of what your policy covers and excludes prepares you to protect your investment effectively.

Types of Roof Coverage in Homeowners Insurance Policies

Homeowners’ insurance policies can provide various types of roof loss settlements. The two main types are replacement cost value (RCV) and actual cash value (ACV). Knowing whether your roof coverage is RCV or ACV is important, as it significantly affects the amount you will receive when making a claim.

Replacement Cost Value (RCV)

Replacement Cost Value (RCV) is defined as the overall expense of replacing the roof at today’s prices, which contributes to the total cost. This amount is calculated after subtracting your deductible. RCV coverage is beneficial because it covers the full cost to replace the roof without accounting for depreciation, ensuring you receive sufficient funds to replace your roof.

For newer roofs, RCV coverage is often available. It offers many homeowners peace of mind by covering the entire replacement cost at today’s prices, minimizing out-of-pocket expenses.

Actual Cash Value (ACV)

Actual Cash Value (ACV) in roof coverage means the payout is based on the depreciated value of the roof. This type of coverage takes into account the age of the roof and its condition at the time of loss, often leading to lower payouts compared to RCV policies.

ACV policies, often used for older roofs, may result in higher out-of-pocket costs for homeowners. If your policy only covers the depreciated value, replacing your roof could be significantly more expensive than with RCV coverage.

Common Exclusions in Roof Coverage

Common exclusions for roof damage coverage include:

- Aging roofs

- Poor maintenance

- Normal wear and tear

- Specific events like flooding and earthquakes

For example, if your roof is neglected or poorly maintained, roof leaks may occur, and insurance is unlikely to cover the damage. A home insurance roof leak coverage is limited with exclusions you must know.

Furthermore, certain roofing materials, such as cedar shake and slate, may be excluded from coverage or affect claim payouts. Homeowners are responsible for routine maintenance and repairs, and insurance generally won’t cover general repairs or issues that arise over time.

Filing a Roof Damage Insurance Claim

After roof damage, follow these steps:

- Schedule a professional inspection to assess the extent of the damage.

- Document the damage with photos and videos from various angles to provide clear evidence for your insurance company.

- Notify your insurance company promptly to avoid claim denial due to late submission.

Your insurance company should guide you through the claims process, but be aware that it’s also beneficial to:

- Obtain multiple repair estimates to strengthen your claim.

- Compare these estimates with the contractor’s to help avoid disputes over repair costs.

- Work with a roofing contractor who can provide a detailed report to your insurance company, ensuring all damage is properly documented.

During the claims process, clarity on the amount covered for roof replacement and any out-of-pocket payments is important for understanding the covered loss. Always seek written confirmation from insurance adjusters regarding the scope of repairs and approval to ensure transparency.

How Roof Age Affects Insurance Coverage

The age of your aging roof can significantly impact your insurance coverage:

- For roofs older than 10 to 20 years, exclusions may apply.

- Insurance may only agree to actual cash value coverage.

- This means the payout will be based on the depreciated value.

- Homeowners may face higher out-of-pocket costs as a result, particularly considering the roof’s age.

Knowing how age, materials, and roof shape affect insurance coverage is essential. Older roofs might receive less coverage, and insurance may not cover the entire cost of replacement, especially if the roof has multiple layers or is made of less durable materials. Awareness of these factors can help manage your insurance expectations and avoid unexpected costs.

Preventative Measures to Maintain Roof Health

Regular and preventative roof maintenance inspections can identify issues before they lead to further issues with significant damage. Trimming trees, keeping gutters clear, and scheduling regular inspections are essential maintenance tasks that help maintain your roof’s eligibility for insurance coverage.

High-quality roofing materials and regular maintenance can minimize the risk of unexpected repairs. Consistent upkeep is crucial since insurance won’t cover damage resulting from neglect. Identifying and resolving roof issues early can prevent bigger problems and extend the roof’s lifespan.

Maintaining a record of roof repairs and replacements can help track its longevity and condition. Regular inspections, prompt repairs, and debris removal are vital steps in maintaining a roof’s condition and ensuring it remains eligible for insurance coverage.

Working with Roofing Contractors and Insurance Agents

Consulting your insurance provider for a list of preferred contractors is a good starting point when needing repairs. Ensuring the roofing company you hire is licensed, bonded, and insured can save you from potential headaches later on.

Effective communication with both your roofing contractor and insurance agent is essential. A reputable roofing company can provide necessary documentation and work closely with insurance professionals to ensure that all repairs are covered and completed to standard. This cooperation can streamline the claims process and ensure you get the best possible outcome.

Can a New Roof Lower Your Insurance Premiums?

Installing a new roof can lead to significant insurance savings, including:

- Savings ranging from 5% to 35% depending on various factors

- An average reduction of about 20% in insurance premiums after a roof replacement

- Discounts offered by insurers for new roofs or upgrades to more durable materials

Factors influencing these premium reductions include the roofing materials used and the roof’s shape, both of which can affect durability. Several factors suggest that investing in a new roof not only enhances your home’s protection but can also result in substantial financial benefits.

Understanding Roof Endorsements and Policy Riders

A roof endorsement is an extra feature added to homeowners’ insurance that changes how roof damage claims are handled. These endorsements can affect policy coverage terms, payout calculations, limits, and exclusions, offering enhanced protection against specific perils.

Special riders can include coverage for costs exceeding your coverage limits for roof replacement and may offer discounts for using impact-resistant roofing materials. Ordinance or law coverage can help pay for upgrades required by local building codes during roof repairs. Understanding these options can significantly enhance your homeowners’ insurance policy.

Key Takeaways

New roofs are more durable and reduce the risk of damage, which can lead to discounts on home insurance premiums. The average lifespan of asphalt shingle roofs is typically around 20 years, and understanding this can help you manage insurance expectations.

Maintaining your roof is crucial for prolonging its lifespan and ensuring it remains eligible for insurance coverage. By implementing preventative measures and understanding your policy’s details, you can protect your home from unexpected events and structural issues.

Home Insurance Roof Coverage Summary

Navigating the complexities of homeowners’ insurance roof coverage can be daunting, but understanding the types of coverage, common exclusions, and the claims process can help you make informed decisions. Regular maintenance and inspections are key to ensuring your roof remains in good condition and fully covered by your insurance.

Remember, investing in a new roof can provide financial benefits and enhanced protection for your home. By working closely with reputable roofing contractors and insurance agents, you can safeguard your home and enjoy peace of mind.

Home Insurance Frequently Asked Questions

What types of roof damage does homeowners’ insurance typically cover?

Homeowners insurance typically covers roof damage resulting from incidents such as fire, wind, and hail. However, it does not cover damage arising from poor maintenance or normal wear and tear.

What is the difference between Replacement Cost Value (RCV) and Actual Cash Value (ACV)?

The primary difference between Replacement Cost Value (RCV) and Actual Cash Value (ACV) is that RCV encompasses the total cost for replacing an item without considering depreciation, whereas ACV reflects the item’s value after accounting for depreciation at the time of loss.

How does the age of my roof affect my insurance coverage?

The age of your roof can significantly impact your insurance coverage, often resulting in reduced coverage and potentially only offering actual cash value, which can increase your out-of-pocket expenses. It is advisable to regularly assess your roof’s condition and discuss coverage options with your insurer.

Can installing a new roof lower my insurance premiums?

Installing a new roof can indeed lower your insurance premiums, potentially reducing them by 5% to 35%. This improvement reflects enhanced protection against damage and other risks.

What are roof endorsements and policy riders?

Roof endorsements are amendments to homeowners’ insurance policies that enhance coverage for roof damage, providing additional protection and potentially covering costs beyond the policy limit. This ensures greater peace of mind for homeowners concerned about roof-related claims.

(352) 293-2449